Builders Insurance: What Your Business Needs To Know

Australian builders are experiencing slim margins, but to help with costs, it pays to have a tight rein on your risk management.

We’re not quite seeing what’s happening in the UK, where builders are pulling in the profits, charging a 10% premium over the price of an existing home.

Back in Australia, you do have some solid choices of insurance coverage to help protect your business against risks, though. There’s a range of those that are legally or contractually required, while others are additional useful protection.

Builders’ warranty insurance

Each Australian state and territory has their own regulations for builders’ warranty insurance. This policy may have a slightly different name in your jurisdiction. It typically covers work from between $3,300 to $20,000. If your project’s value falls in this bracket, you’ll need a certificate of insurance before the relevant local council issues a work permit for work to start.

Builder’s warranty insurance aims to provide a level of security to homeowners should a builder not be able to finish a new build, renovation or fix faulty work.

For a particular project, this policy usually covers:

-

The death of a licenced builder

-

The disappearance of a licenced builder

-

The insolvency of a builder

-

Their deregistration.

This coverage covers your clients for a set period once the project’s completed. Depending on the state or territory in which you’ve built, coverage could be six years for structural defects and two years for other defects.

You’ll need a different policy to cover you and your business.

Builders’ insurance (builders’ liability insurance)

Another policy sometimes confused with builders’ warranty insurance is builders’ risk or builders’ liability insurance. That’s the coverage that protects you. Builders generally select a package of policies for builders’ risk insurance to protect:

-

Against illness and injury

-

Total and permanent disability

-

For stock and tools.

You can opt for a package – usually called builders’ construction insurance - or separate policies. We often find that combining policies can save you on the premium paid.

Contract works insurance

Another policy package will protect your assets and construction-related activities. Contract works insurance, also known as construction works cover, is available for a one-off project or for all of your projects over a year. Coverage usually includes:

-

Accidental or malicious material damage (fire, vandalism, theft, storm and flood damage, earthquakes, cyclones and other natural disasters, as well as theft)

-

Product and public liability (your legal costs, those of the aggrieved third party if their claim is upheld, and extra expenses they incur due to a builder’s negligent activity).

Contract works insurance offers opt-in inclusions, such as cover for:

-

Your materials in transit

-

Existing structural, where you may be contractually obliged to insure them

-

Your equipment and machinery, including scaffolding, cranes, excavator, plant, tools)

-

Damage to and theft at your display home.

Some policies will also cover you for debris removal costs, loss of profits or rental and for a delay in starting construction work (much like business interruption insurance).

Exclusions typically include acts of war or terrorism, bankruptcy/insolvency, electronic data destruction or deletion, and asbestos-related claims.

Other useful types of insurance

As an employer, you’ll also need workers’ compensation insurance and your commercial vehicles will need cover too.

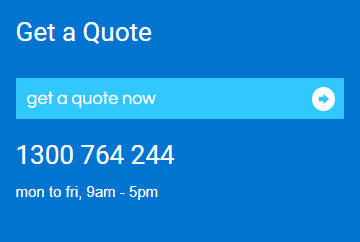

It makes sense to combine policies into a customised package to help keep your business on track. Reach out to us to guide you on best practice risk management.

Any financial product advice in this content is provided by cgib AFSL No. 231183. This material is general in nature and has been prepared without taking into account your objectives, financial situation or needs. Accordingly, before acting on it, you should consider its appropriateness to your circumstances. cgib respects your online time and privacy.