Everything You Need to Know About Professional Liability Insurance

What is Professional Liability Insurance?

Professional liability insurance, commonly referred to as professional indemnity insurance (PII), is a specialized form of coverage designed to protect professionals and businesses from claims of negligence, errors, or omissions in the services they provide. It offers financial protection in situations where clients allege that your advice, services, or products resulted in financial loss or harm.

Understanding Professional Indemnity Insurance

Professional indemnity insurance specifically addresses claims arising from professional services rendered. It is commonly associated with professions such as lawyers, accountants, architects, engineers, consultants, medical practitioners, IT professionals, real estate agents, financial advisors, insurance brokers, and other service-based industries. This coverage helps mitigate the financial risks associated with lawsuits, covering legal costs, court expenses, and any settlements or judgments resulting from covered claims.

Exploring Public Liability Insurance

In addition to professional indemnity insurance, businesses may also need public liability insurance, also known as general liability insurance. This coverage focuses on claims of bodily injury or property damage to third parties that occur in connection with business activities. It is essential for businesses that interact with the public, such as retailers, contractors, and event organizers.

Why is Professional Liability Insurance Important?

Professional liability insurance plays a crucial role in business protection for several reasons:

- Protection Against Claims: In today's litigious environment, businesses face the risk of legal action from clients or third parties alleging negligence or errors. Professional liability insurance provides financial protection by covering defence costs and potential settlements or judgments.

- Client Requirements: Many clients require proof of professional liability insurance as a prerequisite for engaging in business. Having this coverage not only instils confidence in your professionalism but also helps secure and retain clients.

- Risk Management: By transferring the financial risks associated with professional services to an insurance carrier, professional liability insurance allows businesses to focus on their core activities without the fear of crippling legal expenses.

Disclaimer:

This blog serves solely for educational purposes and is not to be used as evidence of insurance. Businesses are encouraged to refer to their insurance policies and documents for further details, including terms and conditions.

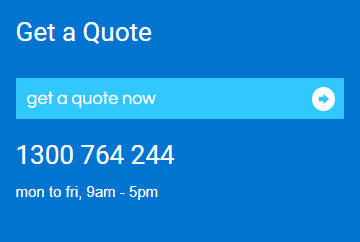

Professional liability insurance, encompassing both professional indemnity insurance and public liability insurance, is an indispensable component of risk management for businesses. By understanding its importance and securing appropriate coverage, businesses can protect themselves from the financial consequences of professional negligence or errors. If you have any questions or would like to explore professional liability insurance options for your business, don't hesitate to contact us. We're here to help safeguard your business and ensure your peace of mind.

Tags: Architects Building Designers Professional Indemnity Professionals Risk Management