Misconceptions about Landlord Insurance Debunked

Australia has about three million rental homes and about 1.7 million landlords, according to University of Sydney research . About one in three landlords own more than one property.

But despite their numbers, plenty of misconceptions abound about landlord insurance. This article covers the main four ones.

Not tenanted? You should still insure it

Typically, a landlord policy will protect your property if it’s unoccupied for up to 60 days. Consider if the property is undergoing major repairs or renovations, or if you’re struggling to find a tenant. It could be unoccupied for longer and not covered.

Insurers regard an untenanted property differently from one that’s vacated. For example, they may be able to decline a claim for a property that’s been vacant for an extended time, such as 90 days.

Your insurance policy doesn’t just run in line with a tenancy cycle

You might think about just having active cover while your property is tenanted. However, those in-between times, when the property is untenanted, open you up to the risks of theft, vandalism, fire, flooding, storms, and even squatting if people notice no-one’s there.

Another issue concerns possible legal liabilities. Even if you don’t have a tenant, if someone is injured on your property, you’re still liable. Think of a would-be tenant inspecting the property and tripping on uneven floorboards. You may even be liable for a trespasser or squatter who injures themselves while on your property.

Cover for pet damage can have caveats

You need to check your insurance policy whether damage caused by a tenant's pet is covered.

Check the relevant tenancy laws for the state or territory where your investment property is located. In NSW, you can include a clause in the lease to prevent tenants from keeping a pet in the house. For strata, a landlord can evict a tenant if they keep a pet for which they haven’t sought permission. The same can happen if they have asked and you’ve refused, yet they still have a pet on the premises. Damages an ‘approved’ pet causes are not considered fair wear and tear in Queensland, by the way. Such damage could include scratch marks on floors, doors or walls, and the tenant should pay for or fix those scratches.

Short-term rentals may not be covered

Using Airbnb and other similar platforms can create a healthier return on your investment than long-term rentals. But the high returns come with increased risks. They include:

-

Safety issues

-

Tenants and their visitors causing a public nuisance

-

Disruption to the neighbourhood

-

Heavier wear and tear on your property.

So, before you put your property on such a platform, check with us if the insurer will cover you.

And, while we’re on the subject of short-term rentals, some policies will reject a claim if a fixed-term lease was not in place. That would occur when a tenant rents on a month-to-month basis.

Landlord insurance for risk management

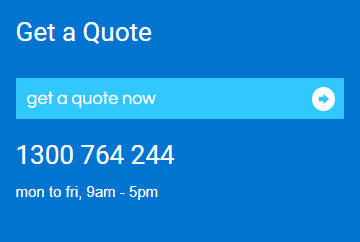

Each investment property and tenancy is unique, so let us guide you on a tailored policy to fit your needs and demystify policy fine print. Landlord insurance policies usually cover storm damage, fire, public liability, and theft, but not wear and tear.

It might feel you don’t have much control over your property once it’s tenanted. But having a robust lease, regular property inspections, and managing your risks, such as with an appropriate insurance policy, can give you much peace of mind.

Any financial product advice in this content is provided by cgib AFSL No. 231183. This material is general in nature and has been prepared without taking into account your objectives, financial situation or needs. Accordingly, before acting on it, you should consider its appropriateness to your circumstances. cgib respects your online time and privacy.

Tags: Landlord Insurance