Safeguarding Your Career: The Foundation of Your Professional Indemnity Insurance

When it comes to preserving your career and maintaining peace of mind as a building designer, there's no room for compromise. That's why selecting the right Limit of Indemnity Sum Insured on your Professional Insurance Policy is paramount.

Why Does It Matter?

Your Sum Insured should function as a robust safety net, providing not just adequate but exemplary protection. Think of it as a shield guarding your professional reputation and financial security. To determine the appropriate amount, consider a simple yet effective rule of thumb: it should be at least double the total rebuilding costs (excluding land value) of your most substantial project.

For instance, if you're involved in a project with a total rebuilding cost of $3,000,000, your Sum Insured should be set at $6 million. This ensures that you are sufficiently covered in the event of unforeseen challenges and legal claims that may arise down the road.

Long-Term Security

But don't stop there. We recommend maintaining this Sum Insured for an extended period, ideally seven years from the time you provided your services. This extended coverage acts as a safeguard against claims that might surface years after your involvement in a project has concluded.

Guarding Against Inflation

In an environment where construction and legal costs are on the rise, it is crucial to ensure that your Sum Insured keeps pace with inflation. This is vital to maintain the level of protection you need. Building and legal costs are escalating, making it even more critical to periodically review and potentially increase your Sum Insured.

For instance, if you currently hold a $1 million Sum Insured, it may be wise to consider a review and adjustment to ensure you are adequately protected in today's rapidly changing landscape.

Disclaimer:

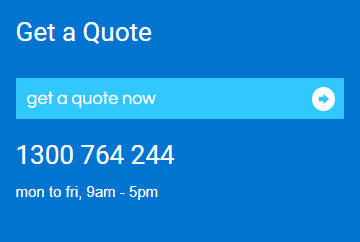

Please note that this article serves as a guide for understanding the importance of an adequate Sum Insured on your Professional Indemnity Insurance. To ensure that you are adequately covered and to receive personalised advice, we strongly recommend reaching out to us for a thorough policy review. Your specific circumstances may vary, and our team is here to assist you in making informed decisions about your insurance needs.

By adhering to these guidelines and staying vigilant about inflation and industry trends, you can rest easy, knowing that you have a robust financial safety net and comprehensive protection in place. This way, you can focus on what you do best – designing exceptional buildings, with confidence in your insurance coverage.

Remember, your career is your masterpiece; protect it with the right insurance. If you have any questions or need further guidance on your insurance policy, we're here to help. Your peace of mind is our top priority.

Any financial product advice in this content is provided by cgib AFSL No. 231183. This material is general in nature and has been prepared without taking into account your objectives, financial situation or needs. Accordingly, before acting on it, you should consider its appropriateness to your circumstances. cgib respects your online time and privacy.

Tags: Building Designers Professional Indemnity Professionals Risk Management