Strengthen Your Construction Insurance: Safeguarding Existing Buildings

At CGIB, we fully grasp the importance of ensuring the comprehensive safeguarding of your projects. Hence, we strongly advocate considering an extension to your existing policy to include coverage for potential damage to existing buildings. This additional coverage not only provides peace of mind but also offers vital financial security in unforeseen circumstances.

Here's an overview of what you need to know about this extension:

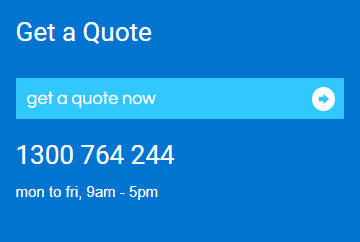

Recommendation: We strongly urge you to secure coverage for potential damage to pre-existing structures at your project site. To proceed, please contact our office.

Scope of Coverage:

Material Damage: Your insurer will indemnify damage to the insured contract works from any cause, except those explicitly excluded, during the construction period. Covered incidents encompass fire damage and theft. However, it's crucial to note that damage to pre-existing property is typically excluded unless specific cover is activated on a job-by-job basis.

Legal Liability Insurance: Public liability coverage encompasses legal liability for compensating personal injury or property damage.

Claim Example: In the event of damage to an existing building, your insurer will assess your responsibility. If deemed at fault, the Legal Liability insurance (Section Two) will take effect. However, if not at fault, the insurer will evaluate Section One (Material Damage). If coverage for existing structures hasn't been extended, no coverage will be provided. Conversely, if extended, coverage will be active.

Additionally, it's vital to consider the building owner's insurance policy, as it may offer coverage for damage during construction, renovation, or alteration. Reviewing the building owner's policy for details is highly recommended. Most Home Building Insurance Policies have conditions and exclusions concerning properties under renovation or construction. Please note that this coverage is arranged on a job-by-job basis to accommodate the diverse nature of your projects.

Key Considerations:

Review your contracts to ascertain if you're obliged to provide coverage for existing building damage, regardless of fault.

Update your building contracts to include a provision requiring the owner to verify their Home Building Insurance Policy for coverage while their home is under construction. If no cover is present, the owner should arrange coverage with the builder on the builder's insurance policy; additional costs will apply.

Ensure all contractors and subcontractors furnish written evidence of current Public Liability Insurance coverage.

Remember that other policy conditions and exclusions apply; please refer to the attached documentation for further details.

Should you have any queries or require clarification, please don't hesitate to reach out. We're here to assist you in navigating your construction insurance needs effectively.

Any financial product advice in this content is provided by cgib AFSL No. 231183. This material is general in nature and has been prepared without taking into account your objectives, financial situation or needs. Accordingly, before acting on it, you should consider its appropriateness to your circumstances. cgib respects your online time and privacy.

Tags: Builders Building Designers Public Liability Trades