The Importance of Good Business Practices and Professional Indemnity Insurance

The Impact of Poor Business Practices on Your Professional Indemnity Insurance

Poor business practices can have several negative effects on your Professional Indemnity Insurance:

- Financial Loss: If a claim is made against you, you will need to pay the policy excess. Depending on the claim's nature and size, this could be a significant out-of-pocket expense.

- Premium Increases: Multiple claims or a major claim can result in increased premiums when it's time to renew your insurance policy. Insurers view businesses with a high claims history as higher risk, leading to higher costs for coverage.

- Difficulty in Obtaining Insurance: Major claims or multiple claims can make it difficult to obtain insurance. Insurers may view your business as a high-risk client, potentially leading to higher premiums or difficulty securing coverage.

- Declined Claims: Insurers may decline claims if they believe poor business practices contributed to the issue. This can leave you exposed to significant financial liability without the safety net of insurance.

Steps to Implement Good Business Practices

To help ensure that you are practicing good business methods, consider the following steps:

- Assess Your Capabilities: Regularly evaluate your ability to meet your contractual obligations. Be honest with your clients about what you can realistically deliver.

- Stay Informed: Keep up with industry trends and updates to provide the best advice possible. Continuous professional development can help in maintaining your expertise.

- Communicate Clearly: Always confirm advice and discussions in writing. Use emails, contracts, and formal letters to document important communications. Ensure that your clients understand the implications of not following your advice.

- Review Contracts with Legal Counsel: Have any contracts you are required to enter into checked by a lawyer. Legal review ensures that you understand the terms and can meet your obligations, reducing the risk of future disputes.

- Avoid Intellectual Property Infringements: Do not copy designs or work from other companies without proper authorization. Respect intellectual property rights and ensure that your services are original and do not infringe on the rights of others.

- Review Your Insurance Policies: Regularly review your Professional Indemnity Insurance policy to ensure it meets your current business and contractual needs. Discuss with your broker any changes in your business that might affect your coverage requirements.

Common Business Practice Mistakes

In addition to implementing good practices, it's crucial to avoid common business practice mistakes:

- Neglecting Contracts:

- Failing to have clear, written contracts for all engagements can lead to disputes over terms, deliverables, and payments.

- Ignoring Client Feedback:

- Disregarding client feedback or concerns can damage relationships and reputation.

- Actively seek feedback and address any issues promptly to maintain client satisfaction.

- Lack of Due Diligence:

- Engaging in projects or partnerships without conducting thorough due diligence on clients, suppliers, or collaborators can lead to financial and legal risks.

- Poor Time Management:

- Inefficient time management practices can result in missed deadlines, delayed projects, and dissatisfied clients.

- Implement effective scheduling and prioritization strategies to optimize productivity.

- Inadequate Risk Planning:

- Failure to anticipate and plan for potential risks, such as economic downturns, regulatory changes, or technological disruptions, can leave your business vulnerable.

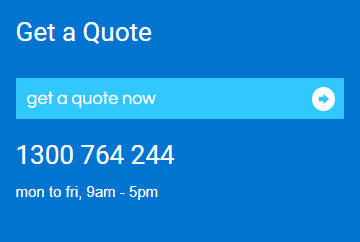

By focusing on these good business practices and avoiding common mistakes, you can enhance the professionalism, reliability, and success of your professional services firm. If you have any specific concerns or need further advice, feel free to reach out to us at CGIB Insurance Brokers.

Disclaimer: The information provided in this blog is for general informational purposes only and should not be construed as legal or professional advice. While we strive to provide accurate and up-to-date information, CGIB makes no representations or warranties of any kind, express or implied, about the completeness, accuracy, reliability, suitability, or availability with respect to the information contained herein. Any reliance you place on such information is therefore strictly at your own risk.

CGIB will not be liable for any loss or damage, including but not limited to indirect or consequential loss or damage, or any loss or damage whatsoever arising from loss of data or profits arising out of, or in connection with, the use of this blog. Through this blog, you are able to link to other websites that are not under the control of CGIB. We have no control over the nature, content, and availability of those sites. The inclusion of any links does not necessarily imply a recommendation or endorse the views expressed within them.

Every effort is made to keep the blog up and running smoothly. However, CGIB takes no responsibility for, and will not be liable for, the website being temporarily unavailable due to technical issues beyond our control.

If you have any further questions or need additional assistance, please feel free to reach out to us.

Tags: Architects Building Designers Professional Indemnity Professionals Risk Management