The Importance of paying premiums by the policy expiry date

The Importance of paying premiums by the expiry date

1. Continuity of Coverage

Insurance policies are designed to provide continuous coverage, protecting your assets and liabilities from unforeseen events. Payment of the premium by the policy expiry date ensures that there is no lapse in coverage. If the premium is not paid on time, the policy may lapse, leaving you without protection.

2. Claims and Non-Payment

If a claim arises after the policy expiry date and the premium has not been paid, the insurer can decline the claim due to non-payment. This means that even if the incident occurs within the policy period, the lack of timely payment can invalidate the coverage, leaving you responsible for all associated costs.

3. Legal and Financial Repercussions

Operating without insurance coverage can lead to significant legal and financial repercussions. For instance, if a liability claim is made against your business during a period when your policy has lapsed due to non-payment, you could face hefty legal fees and settlement costs.

Seeking Payment Extensions

1. Insurer Approval

If you require an extension to pay the premium beyond the policy expiry date, it is essential to seek approval from the insurer. As brokers, we can facilitate this request on your behalf. It's important to note that such extensions are at the discretion of the insurer and must be authorized to ensure continued coverage.

2. Maintaining Coverage

By obtaining approval for a payment extension, you ensure that your policy remains active, protecting you from potential claims during the extended period. Without this approval, any incidents occurring post-expiry date would not be covered.

3. Partial Payments

It is worth noting that insurers typically require full payment of the premium to provide coverage. In cases where only a portion of the premium is paid post the expiry date, the insurer may still decline a claim. Partial payments do not guarantee partial coverage; the policy needs to be paid in full to be effective.

Why Insurance Payment Terms Differ from Other Suppliers

Unlike other types of suppliers, such as building material suppliers, insurance operates on the principle of risk transfer. The insurer takes on the financial risk associated with potential claims, and in return, they require timely payment of premiums to maintain this coverage. This system ensures that the insurer has the necessary funds to pay out claims when they arise, thus protecting all policyholders.

Conclusion

Ensuring timely payment of your insurance premiums is crucial to maintaining continuous coverage and safeguarding your assets and liabilities. If you anticipate needing more time to make the payment, it's imperative to contact your broker and request an extension from the insurer. This step ensures that you remain protected and can avoid significant financial and legal repercussions.

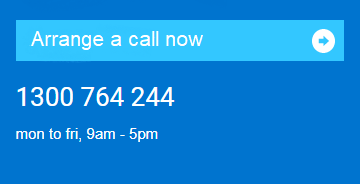

For more detailed advice or to discuss your specific situation, please feel free to contact us. We are here to help you navigate these decisions and ensure your business remains protected.

Disclaimer

This blog is intended for informational purposes only and should not be considered as professional legal or insurance advice. Please consult with your insurance broker and seek legal advice to understand the specific terms and conditions of your policy and the implications of payment delays.

Tags: General Risk Management