The Importance of Run-Off Cover for Public & Products Liability

Understanding Run-Off Cover

At its core, run-off cover serves as an extension of your insurance policy, ensuring that your business remains protected even after you've closed shop or transitioned to a different insurer. The significance of this coverage becomes most apparent for businesses engaged in activities that carry the potential for long-term liabilities, such as those related to public and products liability.

The Importance of Run-Off Coverage: A Practical Scenario

Let's paint a picture to illustrate why run-off coverage is more than just an insurance buzzword. Consider a construction business specializing in balcony construction. Here's how the scenario unfolds:

- Year 1: The business constructs a balcony for a customer.

- Year 5: Tragically, the balcony collapses, resulting in injuries to five individuals.

In this case, the insurance policy that responds to the claim is the one in place during Year 5, the year when the unfortunate incident occurred.

If, using the above example, the client decided that in Year 3, it would cease operating the business and that the policy should not be renewed, it would not have any cover for the claim arising from personal injury in Year 5. Unfortunately, due to the absence of insurance coverage, the business finds itself exposed to significant financial risks and legal consequences.

Safeguarding Your Business: The Role of Run-Off Cover

To avoid these potential pitfalls, it's imperative to consider implementing run-off coverage. This proactive measure ensures that your business maintains insurance protection for any claims that might arise after you've shut down or switched insurers.

Consult with Your Broker

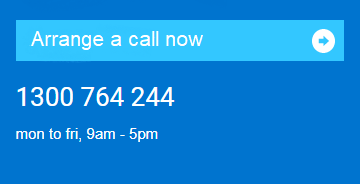

When it comes to navigating the complexities of run-off cover, consulting with a knowledgeable insurance broker is key. They can guide you through the process, helping you understand the specific requirements for securing appropriate run-off cover tailored to your business needs.

In Conclusion

In the complex world of business insurance, protecting your interests against long-tail liabilities is of paramount importance. Understanding the vital role of run-off coverage in the context of public and products liability can be your safety net, preserving your business's financial stability and reputation even after you've concluded your operations. Remember, it's essential to consult with your broker to ensure you have the necessary protection in place.

Securing your business's future isn't just about the present; it's also about preparing for the unexpected challenges that may arise in the future. Run-off coverage is a strategic step in that direction.

Any financial product advice in this content is provided by cgib AFSL No. 231183. This material is general in nature and has been prepared without taking into account your objectives, financial situation or needs. Accordingly, before acting on it, you should consider its appropriateness to your circumstances. cgib respects your online time and privacy.

Tags: Builders Business Insurance Professional Indemnity Professionals Public Liability Risk Management Trades