Understanding the Importance of Dilapidation Reports in Construction Insurance

What are Dilapidation Reports?

Dilapidation reports, also known as building condition reports, are detailed assessments of the current condition of a building or property. These reports are typically commissioned by builders when they are undertaking construction work that may impact neighboring properties or when they are taking over a project on an existing building. They provide an overview of the structural integrity, defects, and any existing damage to the property.

Why are Dilapidation Reports Necessary?

Dilapidation reports serve several important purposes in the construction industry:

- Adjoining Property Protection: In many jurisdictions, builders are required by law to provide protection to adjoining properties during construction activities. Dilapidation reports help assess the pre-existing condition of neighboring properties, allowing builders to mitigate any potential disputes over damage claims that may arise during or after construction.

- Risk Assessment for Insurance Coverage: Insurers often require dilapidation reports to assess the risk associated with providing insurance coverage for construction projects, especially those involving existing buildings or heritage-listed properties. These reports help insurers understand the potential liabilities and risks involved, enabling them to tailor insurance policies accordingly.

- Risk Management: Dilapidation reports play a crucial role in risk management for builders. By identifying existing defects or vulnerabilities in properties, builders can implement appropriate risk mitigation measures to prevent potential damage claims and associated financial losses.

The Importance of Third-Party Contractors

While the need for dilapidation reports is clear, it's essential for builders to engage qualified and licensed professionals to conduct these assessments. We strongly recommend that builders hire third-party contractors, such as engineers or building inspectors, to perform dilapidation reports. These contractors possess the necessary expertise and qualifications to conduct thorough assessments and provide accurate reports.

Furthermore, it's crucial for contractors to carry professional indemnity insurance. This insurance provides financial protection to builders in the event of errors or omissions in the report. If an error in the report leads to a dispute or claim, the builder can approach the contractor's insurer to seek coverage, thus safeguarding themselves against potential financial losses.

Risks of Builder-Conducted Reports and Insurer's Use of Reports

It's important to note that if builders choose to conduct their own reports, they may be at risk of being uninsured in the event of errors or disputes. Insurers typically use these reports as evidence when assessing claims. The report acts as a time capsule, documenting the condition of the building prior to the commencement of the project. This allows insurers to compare the condition of the building at the time of the claim to determine if any changes have occurred. If there are no changes in the building condition, the builder is protected from financial loss.

Disclaimer

This blog serves solely for educational purposes and is not to be used as evidence of insurance. Builders are encouraged to refer to their insurance policies and documents for further details, including terms and conditions.

Conclusion

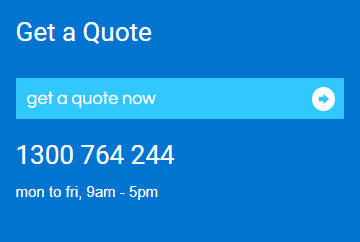

In summary, dilapidation reports play a vital role in construction insurance and risk management. By commissioning these reports and engaging qualified professionals, builders can protect themselves from potential disputes, claims, and financial losses. At CGIB, we are committed to educating and supporting our clients in understanding and navigating the complexities of construction insurance. If you have any questions or need assistance with arranging insurance coverage for your construction projects, please don't hesitate to contact us. Your peace of mind is our priority

Tags: Architects Builders Building Designers Public Liability Risk Management Trades