Understanding the Importance of Professional Liability Insurance for Consultants

What is Professional Liability Insurance?

Professional liability insurance is a type of coverage designed to protect professionals, including consultants, from claims alleging negligence, errors, or omissions in the services they provide. It provides financial protection in the event that a client sues for damages resulting from the consultant's alleged mistakes or failure to perform as promised.

Why Do Consultants Need Professional Liability Insurance?

- Protection Against Lawsuits: Even the most experienced and diligent consultants can face allegations of professional negligence or errors. Whether it's a client claiming financial losses due to inaccurate advice or a project not meeting expectations, lawsuits can be costly to defend against and potentially damaging to a consultant's reputation.

- Client Requirements: Many clients require consultants to carry professional liability insurance as part of their contractual agreements. Having this coverage demonstrates your commitment to professionalism and accountability, which can help you win and retain clients.

- Financial Security: Professional liability insurance provides financial security by covering legal expenses, court costs, and any settlements or judgments resulting from covered claims. Even if you're not ultimately found at fault, the legal costs to defend a claim can be significant. Professional indemnity insurance typically provides coverage for these defense costs, ensuring that you're not left with a hefty bill even if the claim is unfounded.

- Peace of Mind: Knowing that you have insurance protection in place can give you peace of mind to focus on your work and serve your clients effectively. It allows you to pursue new opportunities and take calculated risks without the fear of potential litigation looming over your head.

Additional Insurance Considerations for Consultants

In addition to professional liability insurance, consultants may also need public liability insurance (PLI). Public liability insurance provides coverage for claims of bodily injury or property damage to third parties arising from the consultant's business activities. It's recommended that consultants obtain a combined professional indemnity insurance (PII) and public liability insurance (PLI) policy to ensure comprehensive coverage for their business risks.

Common Misconceptions About Professional Liability Insurance

- "I Don't Make Mistakes": No matter how skilled or experienced you are, mistakes can happen. Professional liability insurance is not just for protecting against blatant errors but also for unforeseen circumstances or misunderstandings that could lead to claims.

- "I'm Covered by General Liability Insurance": While general liability insurance, also known as public liability insurance, provides coverage for bodily injury, property damage, and advertising injury, it typically does not cover professional errors or negligence. Professional liability insurance is specifically tailored to address these risks.

- "I Only Work with Small Clients": Regardless of the size of your clients, the potential for claims exists. In fact, smaller clients may be more inclined to pursue legal action if they perceive your services as crucial to their business success.

Conclusion

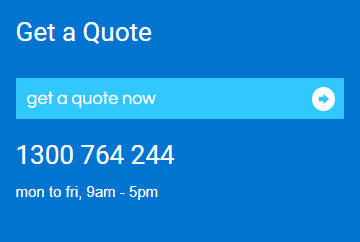

In conclusion, professional liability insurance is a critical component of risk management for consultants. It provides financial protection, legal defense, and peace of mind in an increasingly litigious business environment. At CGIB, we understand the unique needs and challenges faced by consultants, including building design consultants, and we're here to help you navigate the complexities of insurance coverage. If you have any questions or would like to discuss your insurance options further, please don't hesitate to contact us.

Disclaimer: This blog serves solely for educational purposes and is not to be used as evidence of insurance. Consultants are encouraged to refer to their insurance policies and documents for further details, including terms and conditions.

Tags: Building Designers Professional Indemnity Professionals Risk Management